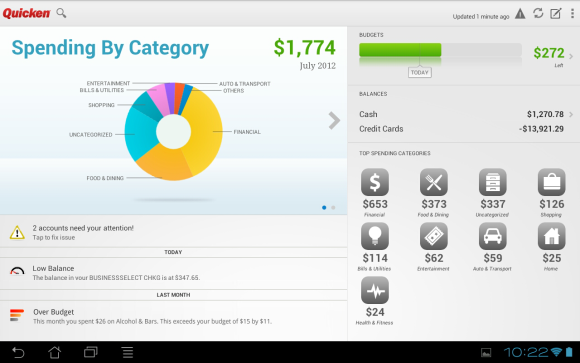

You can try Simplifi free for 30-days, then the cost is as low as $2.99 a month. Set up savings goals for every milestone you are trying to reach.Set up custom watchlists and limits by category, payee, or tags to help stay on track.View upcoming bills, income, transfers, and see how they affect your balances.Find and track recurring bills and subscriptions so you can cancel what you no longer use.Have your transactions automatically categorized.See your banking, credit card, loans and investments all in one place.It also includes a calendar view showing you upcoming expenses. You can identify recurring expenses and subscriptions, which Simplifi then incorporates into the plan. It uses automation to help you better manage your money.įor example, Simplifi can create a spending plan for you by analyzing your income and expenses. Simplifi is Quicken’s version of a mobile budgeting app. Simplifi–Best budgeting app for smartphones If you want automatic downloading of bank transactions, the cost is $39.99 a year. The basic plan costs just $9.99 a year (not a month). Easy to use on web and iOS/Android appsįor the features you get, the cost is very reasonable.Graphical and text-based “widgets” provide quick view of financial activity.Attachment capability for receipts and images.

#How to use intuit mint download

It does enable you to download transactions from your bank and customize both income and expense categories. Unlike Mint, CountAbout doesn’t pummel you with advertisements. In fact, you can import your entire Mint history into CountAbout. It has a feature enabling you to import data from Mint. If you have a lot of data in Mint, CountAbout may be the budgeting tool for you. CountAbout–Best for converting data from Mint Works with 2FA (2-Factor Authentication).Use flexible templates for budgeting and retirement planning.Create your own category rules so every expense is automatically categorized accurately.Track your net worth with flexible, automated dashboards.To get an idea of how it works, check out this video I created. If you like spreadsheets, you’ll like Tiller. The more I use Tiller the more I appreciate the simplicity and ease of use. It then gives you templates and tools to do everything from create a budget to track your spending to save for retirement. In short, Tiller enables you to connect your bank accounts, credit cards and even investment accounts to a Google Sheet (or Excel). But once you understand how it works, it’s a breeze to use.

There is, however, a bit of a learning curve. Along with Personal Capital, I use Tiller every single day. Tiller Money–Best for those who love spreadsheetsįor those focused primarily on budgeting, Tiller Money is the best Mint alternative on our list. Once linked, the dashboard gives you a complete snapshot of your money. You can link just about any financial account to Personal Capital’s app. Like Mint it’s free, and it offers far more tools to keep track of your finances and analyze your investments. Personal Capital can easily replace Mint. Personal Capital–Best Overall Alternative to I’ve known the founder for about a decade and used the tool for years.īest Alternatives to Mint Budget Tracker 1.

Tiller Money–Best for those who love spreadsheets

0 kommentar(er)

0 kommentar(er)